When it comes to financial statements and reporting, there are two main types of engagements: notices to readers (NTR) and reviews. Both engagements have their own purpose and requirements, so it’s important to understand the difference between them.

What is Notice to Reader?

A Notice to Reader (NTR) engagement is the most basic level of assurance engagement performed by an accountant. In this type of engagement, the accountant is not required to perform any procedures to verify the correctness of the information provided by the client. The purpose of an NTR engagement is to provide the reader with a notice that the financial statements have been prepared following Canadian generally accepted accounting principles (GAAP).

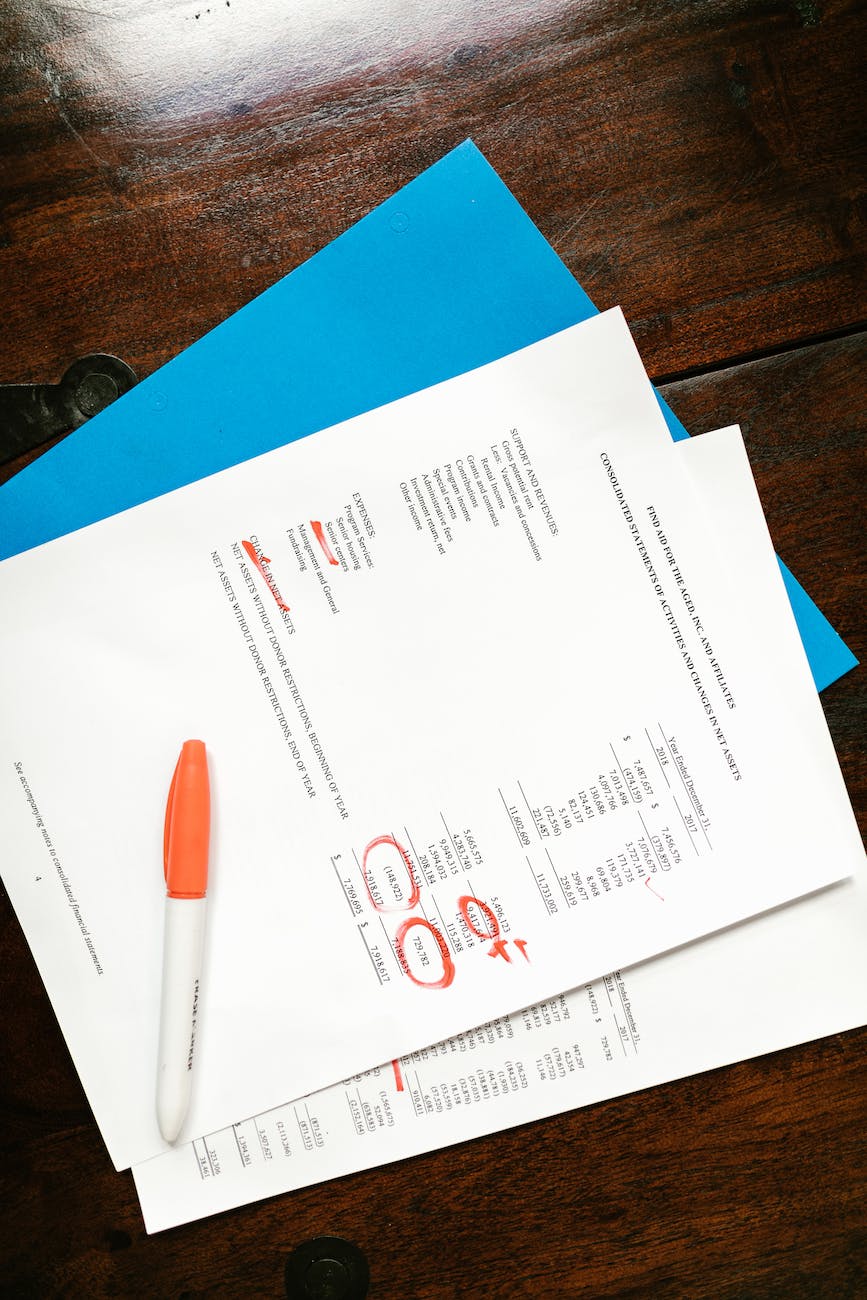

A Certified Public Accountant (CPA) will prepare financial statements for this sort of work. A “Notice to Reader” report is included with the produced financial statements to notify the reader that the statements have not been audited and that the CPA cannot guarantee that the numbers shown are correct.

The CPA’s role is limited to compiling financial statements from data given by the client or the client’s bookkeeper.

What Is Review Engagement?

Review engagements are conducted by professional accountants to provide an objective opinion on an organization’s financial statements. Review engagements require the accountant to obtain a sufficient level of understanding of the organization in order to express their opinion.

A review engagement is less intensive than an audit and, as such, may not involve all of the procedures that would be completed during an audit. However, a review engagement will still provide the reader with valuable information about the financial statements being reviewed.

Banks, shareholders, and other interested parties in a firm often seek a review engagement to verify the accuracy of the numbers included in the financial statements. In contrast to a Notice to Reader, which gives no guarantee, a review engagement provides some assurance from the CPA.

In order to verify the accuracy and completeness of the financial statement data, the accountant will engage in a number of different analytical techniques and consult with the customer. If the CPA thinks the numbers in the financial statements make sense, they will provide a review engagement report.

What is Materiality?

Financial information is considered to be “material” if its absence or misstatement could have a big effect on the financial decisions made by people who use the financial statements.

The auditor uses the idea of materiality throughout both audit preparation and execution. It’s also utilized to create the auditor’s judgment and determine the impact of any errors found during the audit or in the financial statements that were not caught and remedied.

Quantifying what is “material” may be done in several ways. The auditor’s expert judgment and skepticism will determine what’s best for your organization.

Takeaway

When comparing Notice to Reader vs review engagement, a Notice to Reader engagement is suitable for situations where the client is not relying on the accountant for a high level of assurance. This could be because the client has other experts, such as lawyers, who have reviewed the financial statements. Alternatively, the client may have decided that they do not need a high level of assurance and are comfortable with a lower level of protection.

A review engagement is more suitable when the client is relying on the accountant for a higher level of assurance. The accountant will perform additional procedures to obtain this higher level of assurance. For example, the accountant may confirm items with third parties, such as banks or suppliers.